We’ve all seen them — the outrageous emails offering millions from a mysterious foreign prince in exchange for a “small” fee. These classic advanced fee scams have been around since the early days of the internet, often dressed up with official-sounding language and long email threads to lure victims.

But Fortra Brand Protection recently uncovered a new twist: a sophisticated scam built around a fake banking website. It starts with a familiar hook — an alleged lawyer from Togo claiming that inheritance funds are trapped in a foreign bank. To sell the story, scammers share a link to a convincing, but entirely fabricated, banking site. They even provide login credentials and register a deceptive domain name to make the scheme look legitimate.

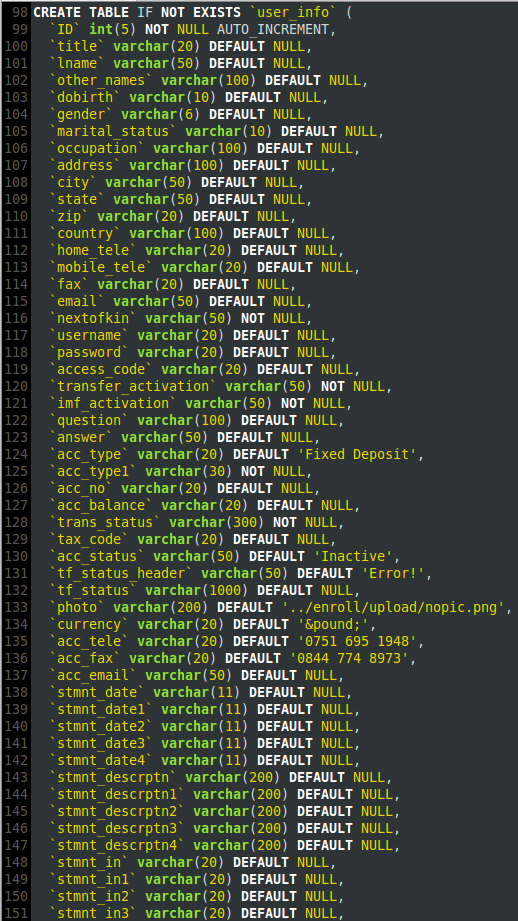

The credential theft site was built from the ground up, even utilizing a database structure to handle user accounts.

Figure 1. MySQL database creation script for fake website.

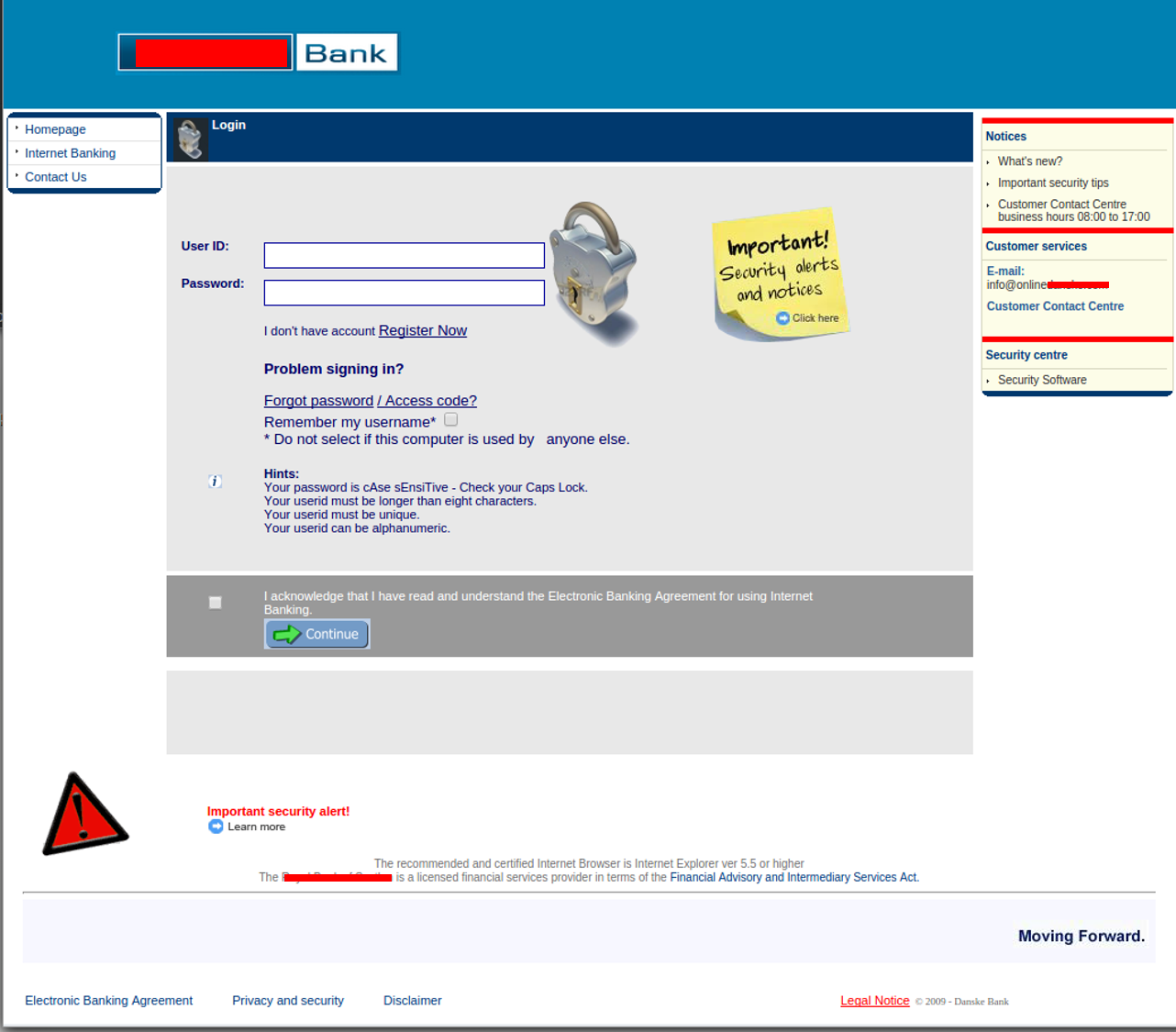

The login page is easily mistaken for a legitimate banking login page (Figure 2). Once on the site, the user then enters the previously provided login information.

Figure 2. Fake login page allowing users to log in to transfer funds in scam.

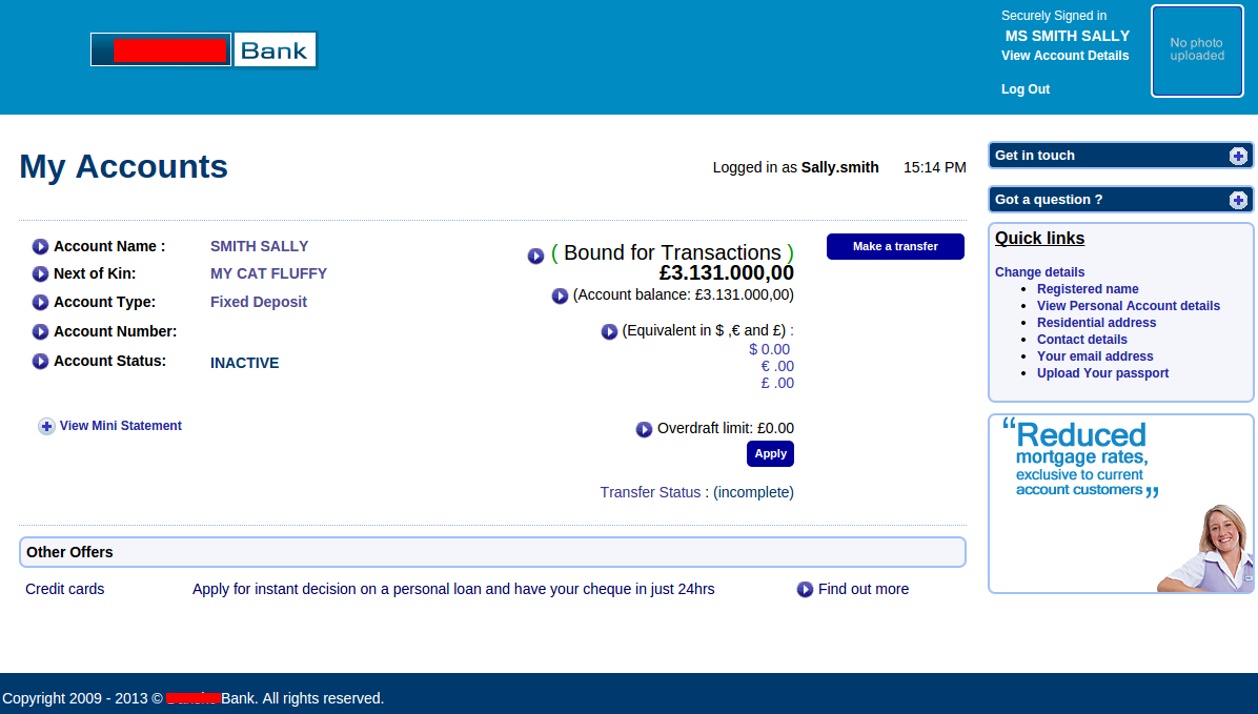

Once logged in, victims are greeted with a seemingly impressive account balance and a prominently displayed transfer button. To reinforce the illusion of legitimacy, the fake bank portal even offers features like editing account details and uploading a profile photo.

Figure 3. Fake bank account showing available funds for transfer in advanced fee scam.

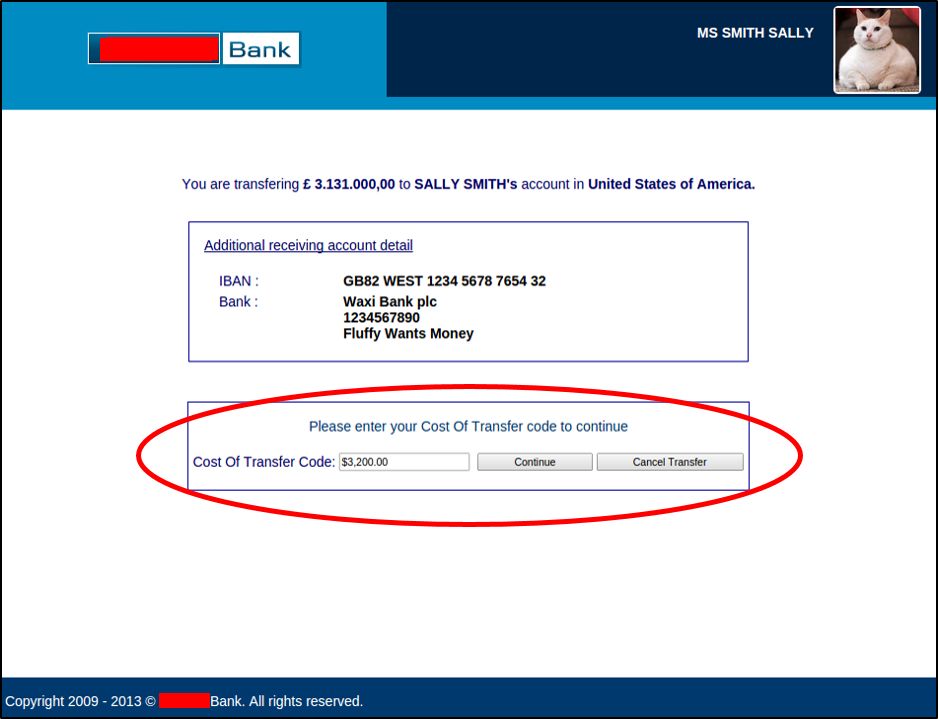

The user is asked for a required “Cost of Transfer Code" which requires several thousand dollars — a small price to pay for a soon-to-be millionaire. After agreeing to pay the fee, the curious individual, now turned victim, can proceed with the fictitious transfer.

Figure 4. Cost of transfer code ($3,200) required to “transfer" funds.

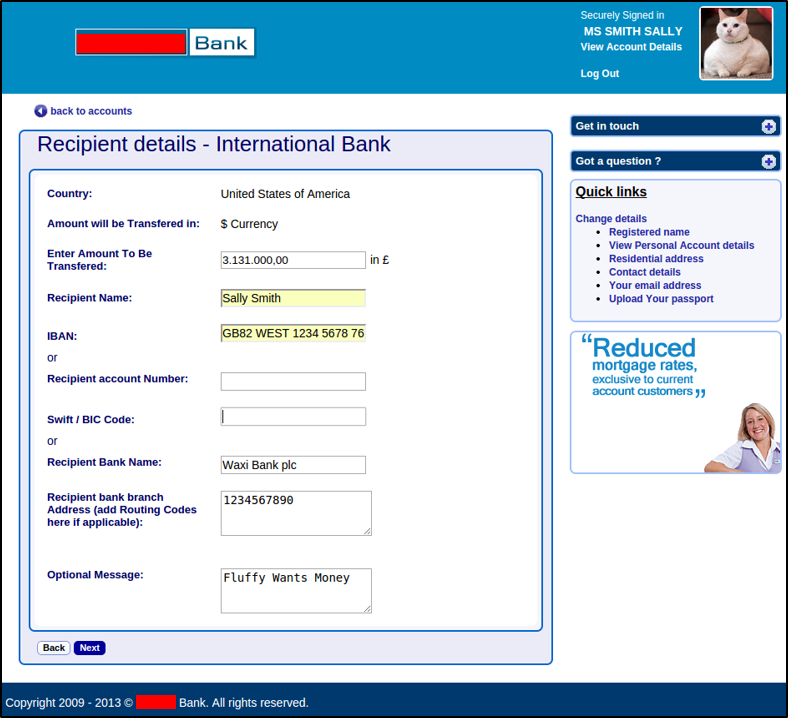

The victim is required to enter bank account details, further convincing them that funds will be transferred.

Figure 5. The fake login site requires bank account information to transfer funds.

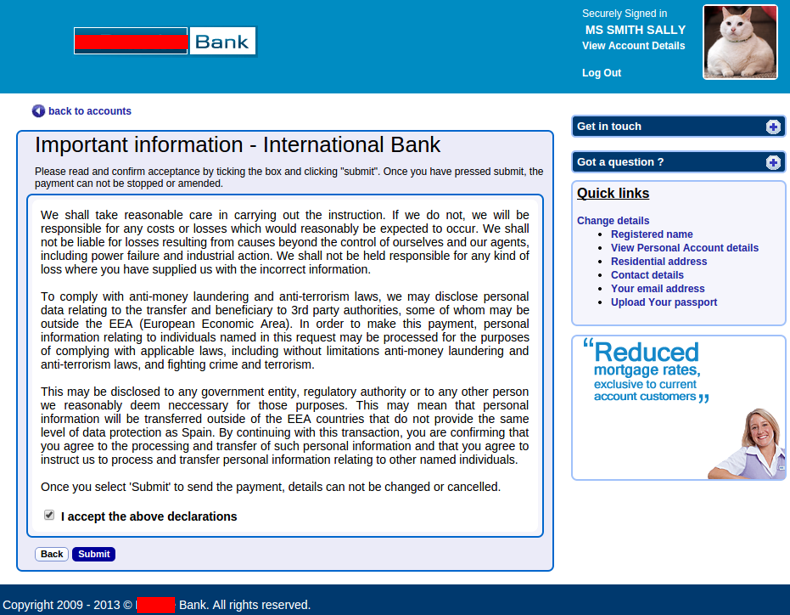

Victims are funneled through a series of polished pages, complete with international banking details, disclaimers, and transfer progress screens. The elaborate design isn’t just for show; it’s a deliberate tactic to distract, stall, and keep victims invested before they realize the entire operation is a sham.

Figure 6. Declarations and acceptance requirements designed to deceive victims.

Not Your Typical Advanced Fee Fraud

At first glance, the site looked like a typical phishing page. But a closer inspection revealed a much more sophisticated operation: a fake banking portal, complete with fabricated account balances, meticulously designed to support an advanced fee scam.

For financial institutions, the threat goes beyond individual losses. These schemes undermine customer trust and tarnish the reputation of banks whose names are exploited as part of the deception. Raising awareness and encouraging account holders to be skeptical of unsolicited offers, especially those involving large sums, is essential to minimizing the damage.

Additional Resources:

Phishing Isn’t new ... But it Never Stops Evolving

Learn how your organization can combat the threat of phishing through a demo with Fortra Brand Protection.